Higher order value per sale

Fewer abandoned checkouts

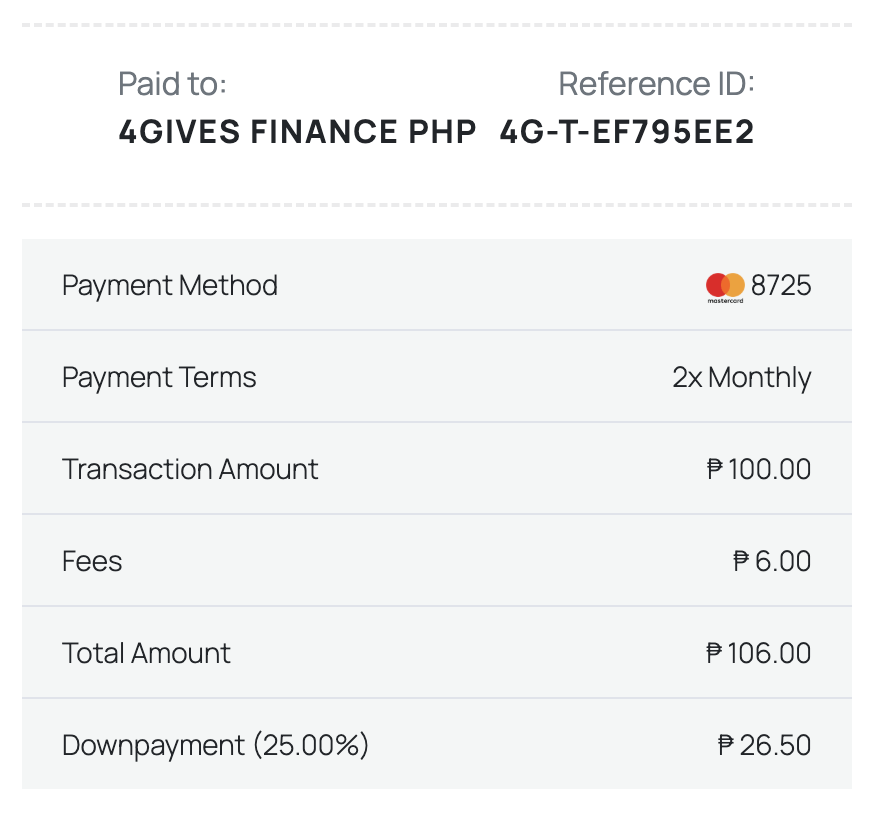

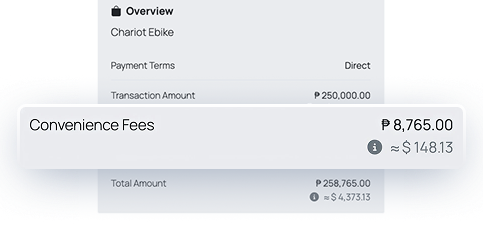

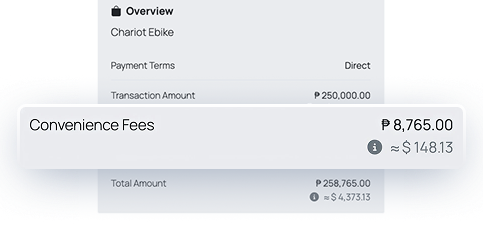

Minimal fees

Everything You Need to Offer

Installments

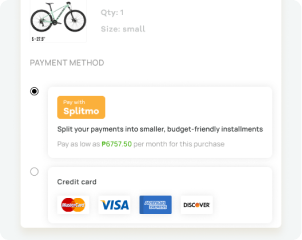

Splitmo turns any credit card payment into smaller, budget-friendly installments that encourage responsible spending.

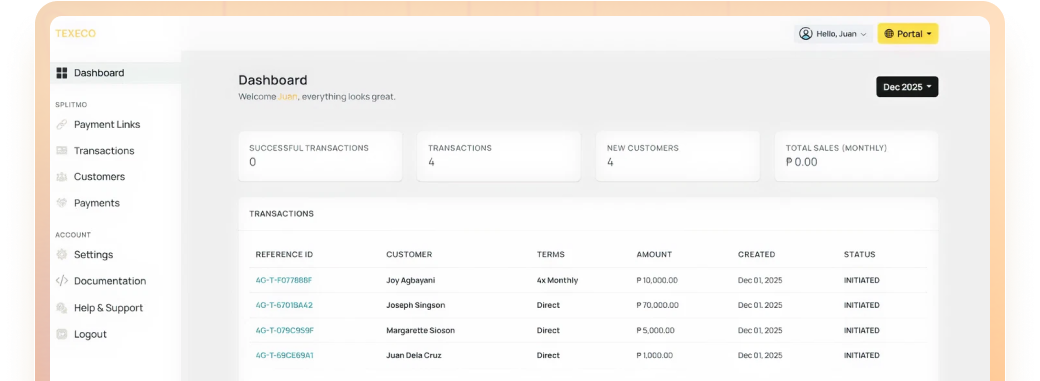

One Platform for All Cards

Accept Visa, Mastercard, JCB, and Amex installments in a single dashboard.

Instant Checkout Links

Generate payment links in seconds and send via SMS, QR code, or email.

Flexible Installment Plans

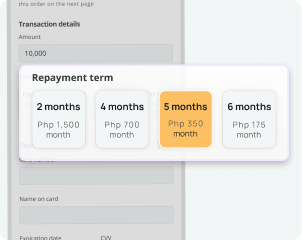

Let customers choose terms that fit their budget while you get paid in full.

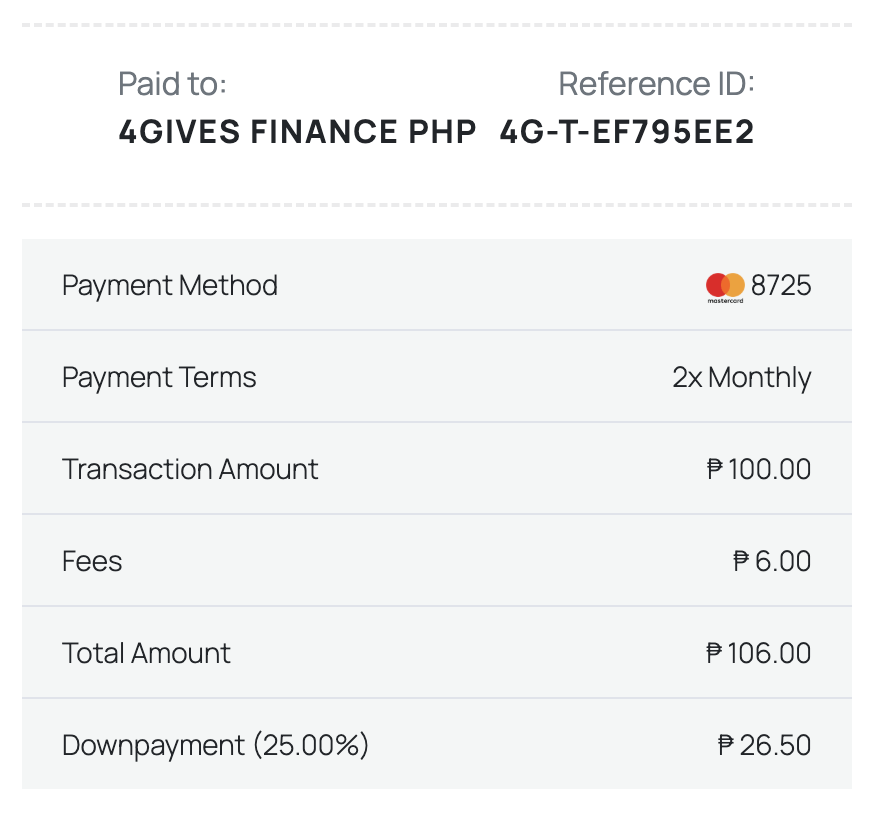

Upfront Payouts

Receive the full amount with no deductions, no waiting for each installment

Easy Setup

Plug Splitmo into your current flow without new bank approvals.

How Splitmo Works

Splitmo turns any credit card payment into smaller,budget-friendly installments that encourage

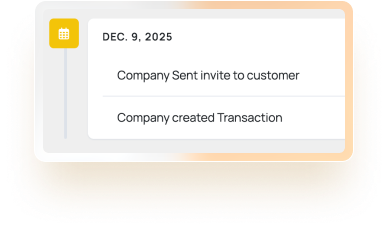

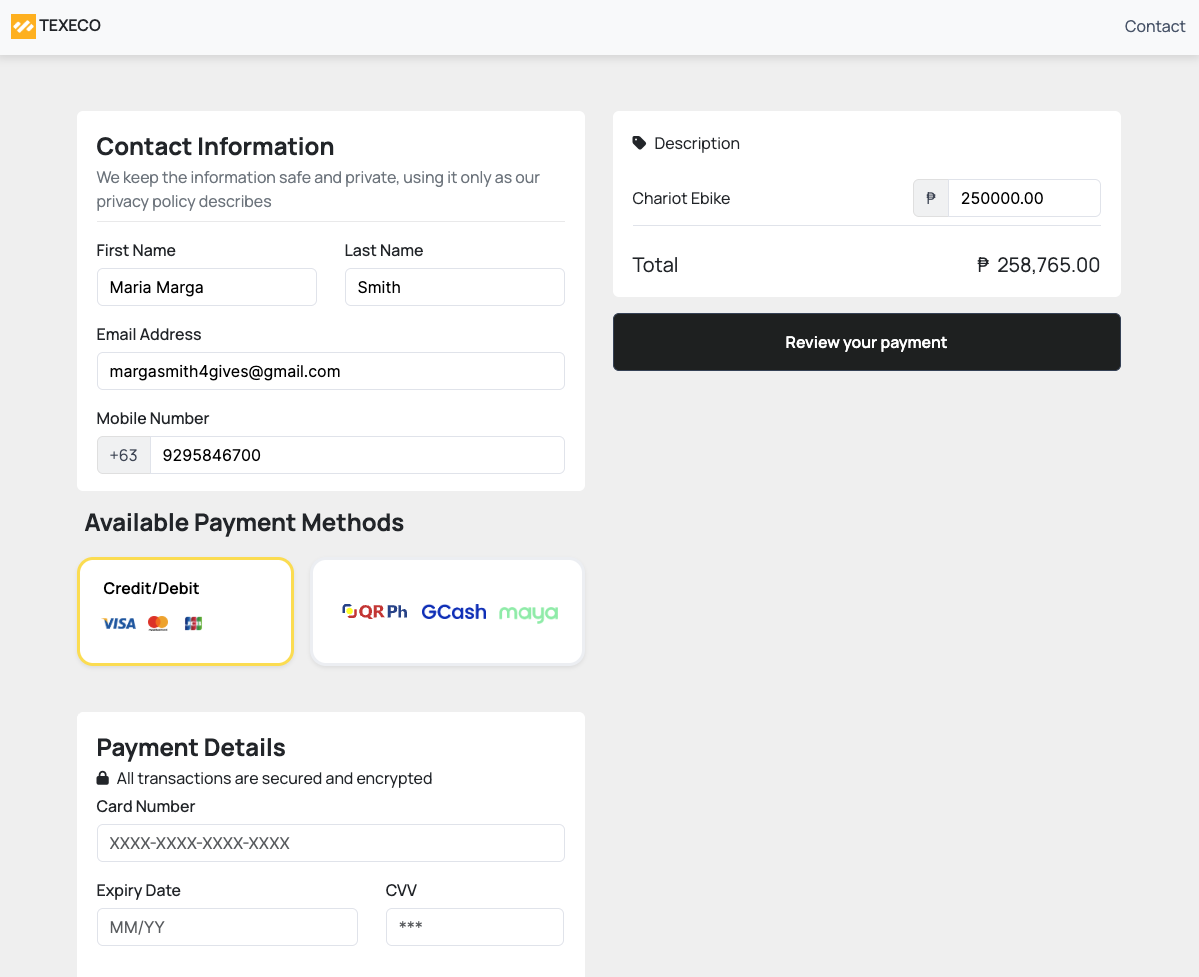

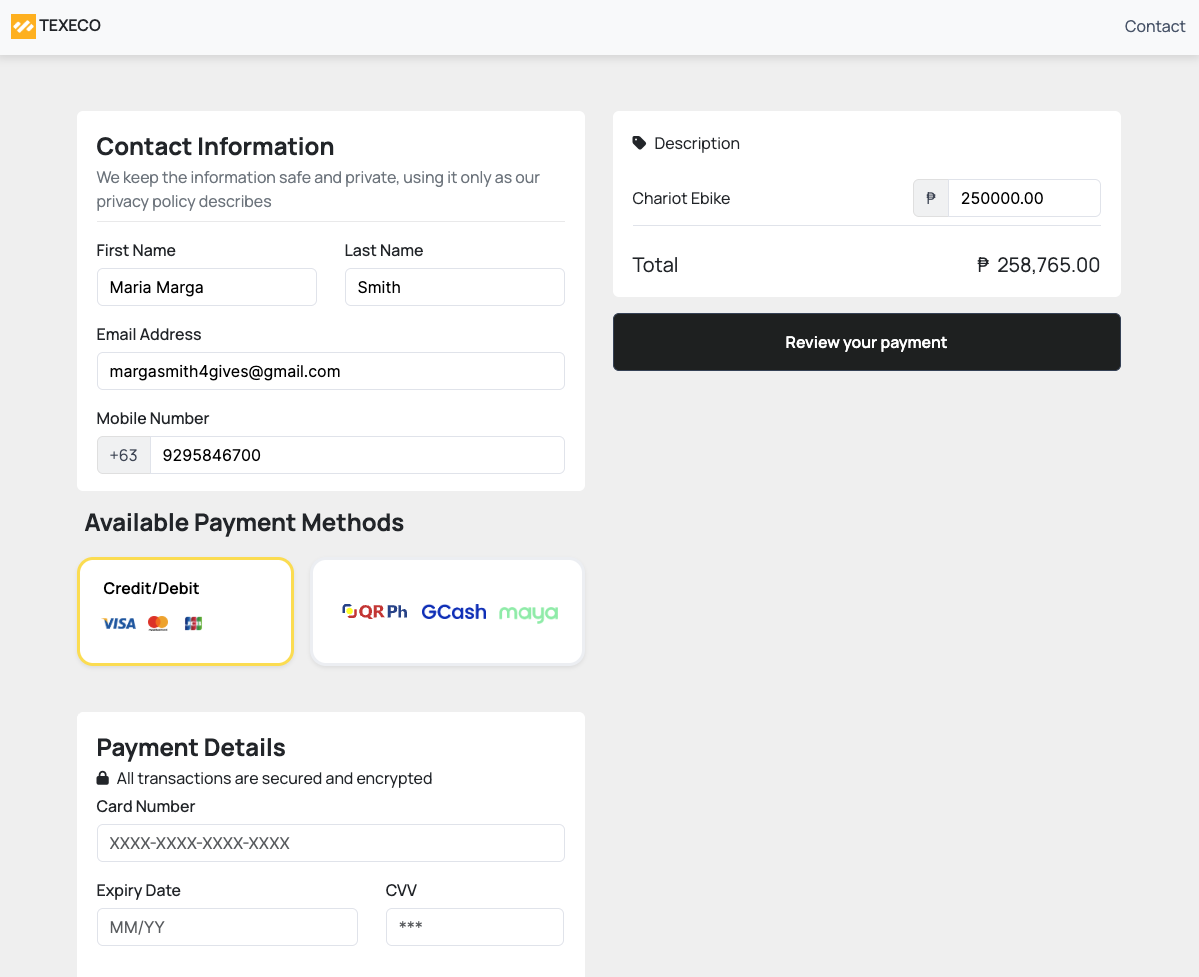

Step 1

Customer chooses Splitmo

Your customer selects Splitmo at checkout and we send a secure payment link to your customer’s phone.

Step 2

Customer enters card & terms

They use their existing credit card and choose their preferred installment plan.

Step 3

Payment completes

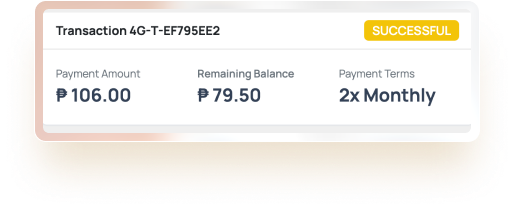

Customer confirms transaction—Splitmo handles the installments while you get paid upfront.

Make every checkout count.

Use Splitmo installments to reduce cart abandonment,lift order value, and convert more credit card customers.

Decrease cart abandonment

Give customers a flexible way to pay so they complete more checkouts instead of dropping off at payment.

Higher average order value

Make upgrades, add-ons, and bundles feel affordable by spreading payments into smaller installments.

Drive more conversions

Use fast, link-based checkout and simple steps that turn more interested shoppers into paying customers.

0% card processing fees

Offer card installments on major credit cards while keeping your full margin—no processing fees on your side.

Fits right into your checkout

offer installments without changing how you work.

Frequently Asked Questions

Quick answers about how Splitmo works for yourbusiness and your customers.

We do not store any sensitive card information — ensuring customers’ data remains fully secure.

Any business offering higher-value purchases or looking to provide installment options can benefit from Splitmo.

Can't find what you're looking for?

The Splitmo team is always here to support

you and your business.

Ready to turn more credit

card checkouts into sales?

Book a demo to see how Splitmo lets your customers pay in installments with their

existing credit cards—while you get paid upfront with 0% processing fees.